Big Box Phoenix Market Added 40 New Vacancies in 2024

As 2024 came to a close, the Velocity Retail Group team wrapped up our annual big box analysis which is a thorough review of every big box greater than 10,000 square feet. Teams drive the entire market to ensure accurate information. The study revealed 40 new boxes added to the inventory of vacant big boxes in metropolitan Phoenix. Even with this increase, there are signs of resilience with retailers, particularly for those with a keen eye on opportunities.

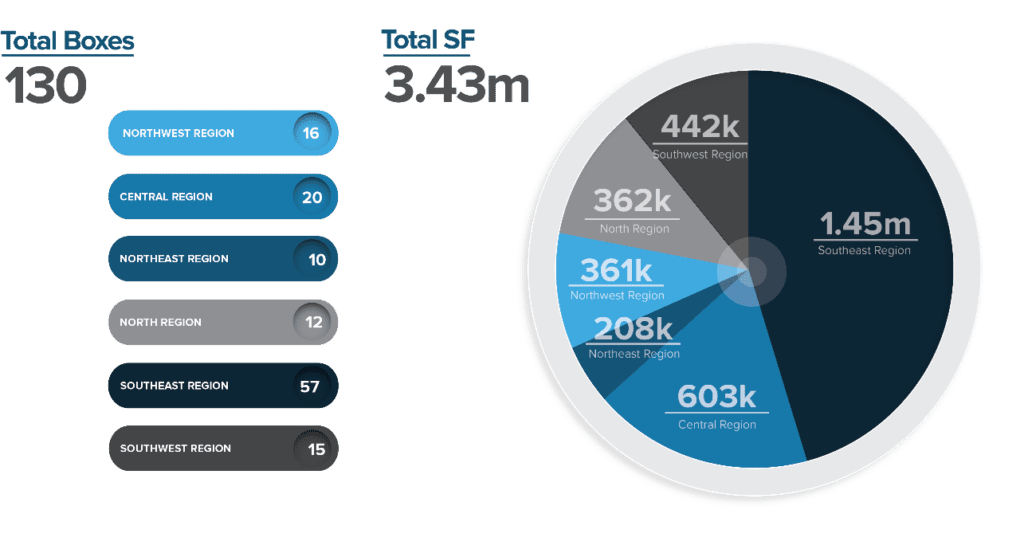

At the end of 2024, 130 big-box spaces, totaling 3.43 million square feet, were vacant. This marks a sharp 44% increase from the end of 2023, when only 90 buildings totaling 2.33 million square feet were vacant.

Total Vacant Big Boxes by Region and Total Square Foot

Where Did the Vacancies Come From?

Nationwide, retail closures hit a staggering high in 2024, with over 7,300 store closures across the U.S. This marks a 57% increase over the previous year, confirming that retailers are constantly adapting their store fleet and market strategy to meet consumer demands. For many retailers, inflation brought lower sales, and rising rents and occupancy costs squeezed profits. Some retail chains did not survive. American Freight Furniture, Big Lots, Party City, 99 Cent Only, drug stores, Conn’s Appliances were the most significant contributors to the big box vacancy increase.

While Phoenix also experienced closures, the impact of these national trends is more nuanced. Though some familiar names are shuttering stores, many of these closures are in well-located areas and were leased soon after the store closure.

While big-box vacancies now account for 36.1% of total vacancies in the market—up 10% from the previous year, this uptick doesn’t tell the whole story. These shifts reflect a changing retail landscape, both nationally and regionally, that’s forcing landlords and tenants to re-evaluate how they approach the leasing process. Phoenix is still a prime location for strategic leasing opportunities. Existing boxes are generally less expensive than a newly constructed space, providing retailers with more affordable options. However, landlords have been aggressive with asking rents, keeping some retailers out of the market. We anticipate that during 2025 rental rates will ease as the competition with more available big boxes will force rents to normalize.

Regional Shifts: Opportunities Across the Valley

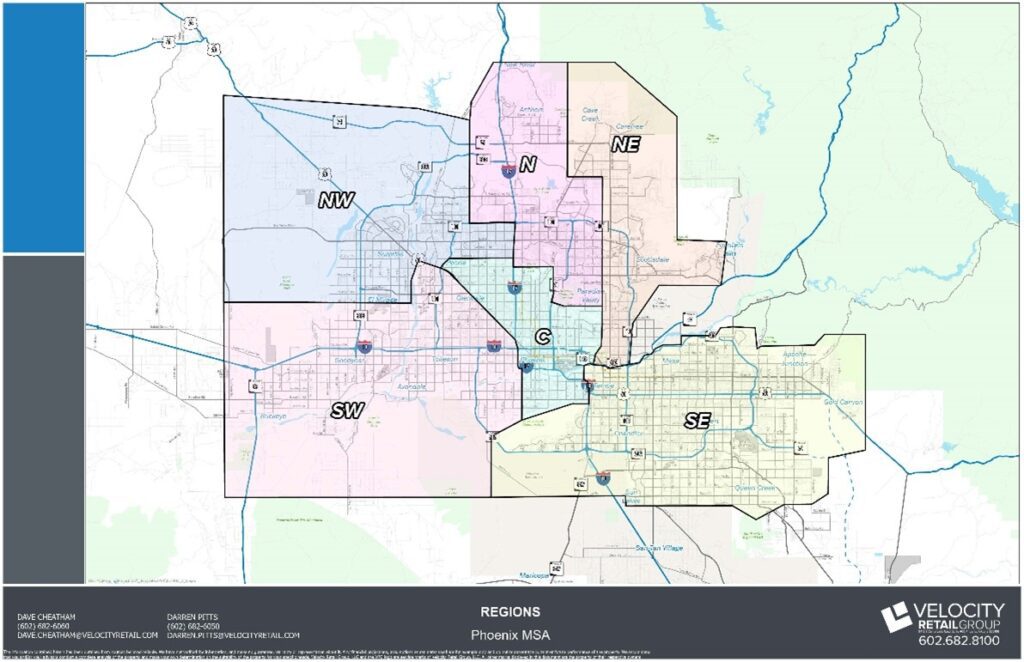

Velocity Retail Group divides the market into six distinct regional areas. At year-end 2024, the Northeast region had only 10 vacant big boxes and tallied the lowest overall vacancy in the Phoenix metro area. While the Central and Southeast regions had the highest vacancy rates and the most big boxes available. Landlords in those regions should be keenly aware of this as they have more competition for their vacancies.

Map of Regional Areas

Leasing Activity

During 2024, nineteen big boxes were leased totaling 429,000 in gross square feet. In 2023, there were 45 big boxes leased, totaling nearly 1.1 million gross square feet. While the Southeast valley had the highest vacancy rate it also comprises 38% of the entire Phoenix metro market. The Southeast region also experienced the most big box leasing activity of 316,767 square feet, from various grocery stores, gyms and entertainment users. Contributing factors include the region’s strong economy, thriving job market, and excellent quality of life. Home to major employers in tech, aerospace, healthcare, and finance, the southeast region offers career opportunities while maintaining safe neighborhoods with top-rated schools and family-friendly amenities. Cities like Gilbert and Chandler are considered some of the best places to live in the United States.

Looking Ahead: Opportunity in 2025

We’re confident that the big-box sector in Phoenix will continue to improve. Even with national retail closures and shifts in consumer behavior, the Phoenix metro area remains a popular destination for companies looking to lease big-box space.

In fact, 2025 may very well bring an uptick in leasing activity as retailers respond to growing demand for space in strategic areas. We may even see more creative adaptive reuse of space, where vacant big boxes are repurposed for new retail formats, entertainment concepts, medical uses, or other high-demand sectors. This adaptability is key to understanding how the market will move forward.

Velocity Retail Group continues to lead the market in leasing and selling the most big box space of any firm in the area, and represents many big box retailers who change the landscape of retail centers and bring exciting concepts to our market.